Understanding the Social Security Fairness Act: A New Era for Government Pension Recipients

The recent overhaul of Social Security benefits through the Social Security Fairness Act marks a significant turning point for those who receive government pensions from work that did not contribute to Social Security. With the elimination of the windfall elimination provision and the government pension offset, many beneficiaries and their families now face a transformed landscape filled with twisted issues, tricky parts, and subtle details that require a closer look.

For decades, these two provisions have reduced the Social Security benefits for individuals who had extensive careers in government service while receiving pension incomes from roles that were not subject to Social Security taxes. Both measures, intended to adjust benefits for disparities in funding, have been met with criticism for their complicated pieces and often overwhelming consequences on those affected. Now, as the Social Security Fairness Act comes into full effect, claiming strategies, benefit calculations, and planning for retirement are being reexamined by experts and beneficiaries alike.

Changes in Benefit Calculations: Digging Into the Fine Points

The heart of the reform lies in eliminating the windfall elimination provision and government pension offset, which historically diminished the benefits for government workers by altering the calculation methods for their own Social Security benefits. In simpler terms, these provisions dampened the expected payouts for individuals who had careers where Social Security taxes were not consistently paid.

Key Alterations in Social Security Calculations

The changes brought by the Act are aimed at balancing fairness for all beneficiaries. Below is a table that outlines the traditional approach versus the new approach under the Social Security Fairness Act:

| Aspect | Old Method | New Method |

|---|---|---|

| Pension Integration | Reduced Social Security benefit due to non-covered pension earnings | Full Social Security benefit calculation regardless of non-covered pension |

| Windfall Elimination Provision | Adjusted benefit formula, causing lower payouts | Provision eliminated, ensuring fairer benefits |

| Government Pension Offset | Subtracted benefits if one receives a government pension | Elimination of offset ensuring beneficiaries receive their full spousal benefits |

This shift means that many individuals, such as retired teachers, police officers, or other public servants, will no longer face the reductions they once did. The revised formulas can have significant effects, particularly for those who are near qualification thresholds and must now decide how best to structure their retirement benefits.

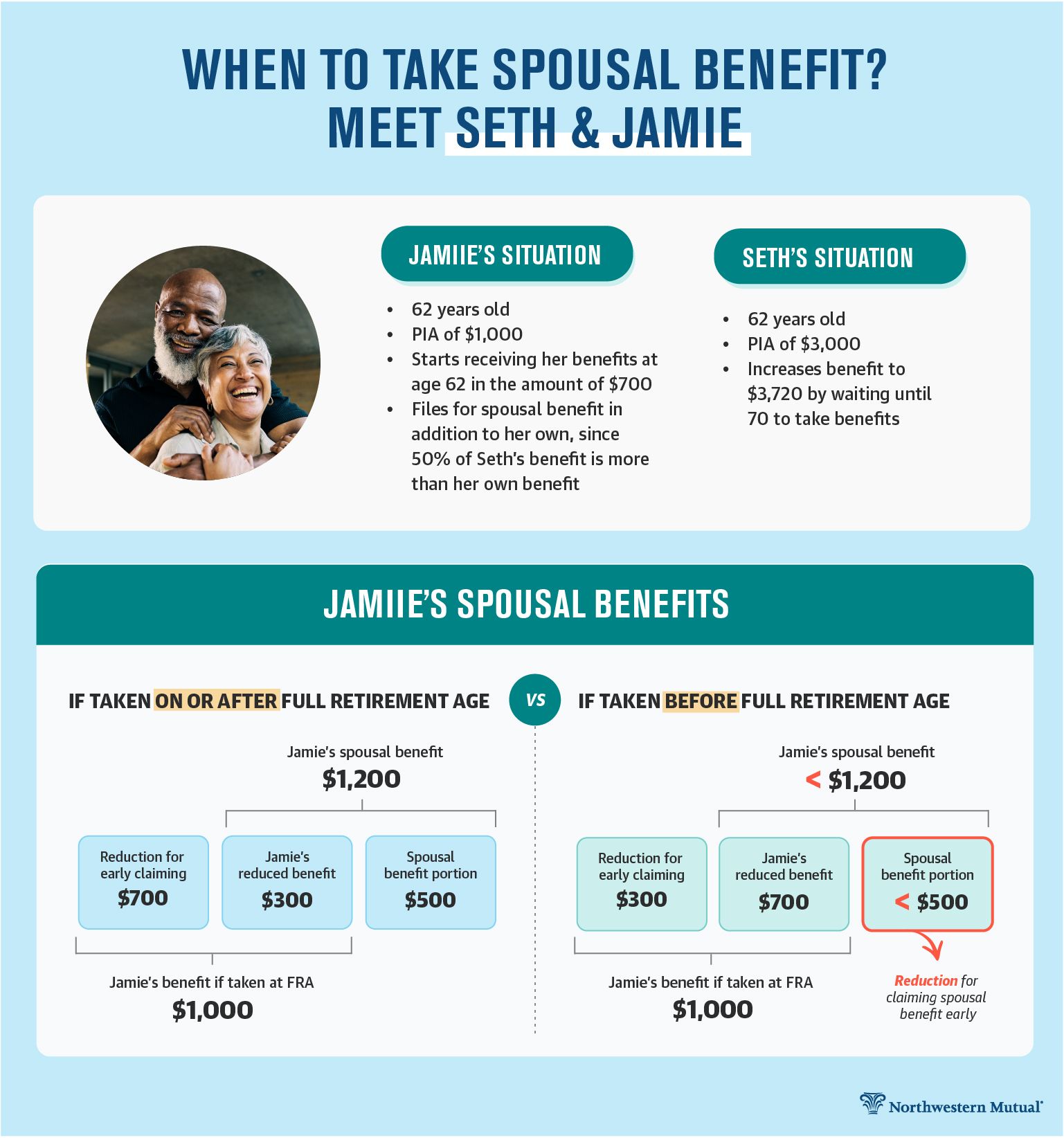

Deciding Between Individual Benefits and Spousal Benefits

One of the central dilemmas for beneficiaries has been determining whether to claim their own Social Security benefits or to opt for spousal benefits. Under previous rules, the strategic decisions often resembled a maze of twisted issues, with many caught in a dilemma between earning additional credits and securing spousal benefits. With the modifications introduced by the Act, understanding the full implications of these choices becomes even more critical.

When Is It Better to Rely on Spousal Benefits?

A common scenario involves individuals with limited credits from low-paying jobs over several decades. In such cases, the calculation of their own Social Security benefits might yield a lower amount compared to the spousal benefit, which can be up to 50% of the higher earner’s Social Security benefit at full retirement age. Here are some key points to consider:

- Credit Requirements: To qualify for your own benefit, you normally need 40 quarterly credits (equivalent to about 10 years of work history with Social Security contributions). If you are short of credits, your own retirement benefit may be significantly smaller.

- Spousal Benefit Calculation: If your spousal benefit exceeds your own benefit, you could be considerably better off electing that option, provided that your spouse has already claimed their benefit.

- Timing Considerations: Spousal benefits are generally reduced if claimed before reaching your full retirement age, and they do not increase if you delay beyond that age. Thus, planning the optimal time to claim benefits is super important.

Individuals in these situations might find it worthwhile to question whether taking on additional work to earn the extra two credits needed to qualify for a personal benefit would be worth the potential gains, and whether or not the spousal benefit option offers a more generous alternative.

Case Analysis: A Retired Special Education Teacher’s Dilemma

Consider the scenario of a retired special education teacher who has received a government pension for years. With 38 of the 40 required credits attained, she faces a tricky decision: Should she return to work for two more quarters or rely on her spousal benefit derived from her husband's Social Security record, with the promise of potentially higher payouts? This situation epitomizes the maze of choices many find themselves in following the reform.

Breaking Down the Options

Let’s dissect the situation into a few clear parts:

- Option A: Returning to Work – Earning the two additional credits would allow her to qualify for her own Social Security benefit, which would be calculated based on her lifetime earnings record. However, if her earlier earnings were low, her calculated benefit might be modest.

- Option B: Electing Spousal Benefits – Opting for a spousal benefit would provide her with up to 50% of her husband’s Social Security benefit (assuming he has claimed or is ready to claim his benefits). Given that spousal benefits are designed to supplement earnings records with limited credits, this option might be more favorable, especially if the husband’s benefit is significantly higher.

With the elimination of the offset provisions, the calculation is now more straightforward. Yet, it is still filled with twists and turns that can be intimidating for those unfamiliar with the nitty-gritty of Social Security rules. Consulting with a financial planner or benefits specialist who can help figure a path through these tangled issues is often a key step before making a decision.

Planning Your Retirement Benefits: What to Consider Now

The Social Security Fairness Act does more than simply adjust payouts; it redefines how beneficiaries plan their retirements. For many, understanding the changes requires a deep dive into the mechanism behind benefit calculations and the possible adjustments they might soon receive as retroactive corrections are distributed.

Potential Retroactive Payments and Notifications

The transition includes a phase where Social Security is mailing out notices to affected beneficiaries. For many individuals, particularly those who previously experienced benefit reductions due to the government pension offset, the new process may involve receiving retroactive payments. Below are some essential points to keep in mind:

- Retroactive Adjustments: The Act provides for retroactive payments that cover the period dating back to when the provisions were lifted, ensuring that individuals receive the full benefits they are now entitled to.

- Impact for Surviving Spouses: For surviving spouses, the effect is usually minimal. Most adjustments will be made automatically, which alleviates some of the nerve-racking complexities of managing claims independently.

- Staying Informed: Beneficiaries who have not yet received notices should keep a close watch on their Social Security statements and consider calling the agency if uncertainties arise. Maintaining records and understanding your benefit history is critical in ensuring that you receive the correct adjustments.

It is worth noting that while many affected individuals will see improvements in their benefit amounts starting from the month the new law takes effect, not everyone will have the same experience. The true impact may vary depending on individual work histories and pension details, making personalized financial advice a super important part of preparing for retirement under the new regulations.

Implications for Spousal Benefits and Survivor Benefits

The reform does not solely benefit individuals with their own inconsistent work records; it also has important repercussions for spouses and survivors. By eliminating the government pension offset, the path to accessing a full spousal benefit is now considerably less labyrinthine.

Understanding Spousal Benefit Calculations Under the New Law

Previously, the government pension offset could drastically reduce the spousal benefits for partners whose spouses had pensions from non-covered employment. Now, with that provision removed, surviving spouses and those who are still married have an opportunity to access up to 50% of the higher earner’s Social Security benefit at full retirement age. Key factors include:

- Eligibility Requirements: As with personal Social Security benefits, spousal benefits require that the primary earner be receiving their own benefits. This means that the timing of when benefits are claimed is a super important consideration for couples planning their retirements.

- Benefit Reductions: If the spousal benefit is claimed prior to reaching full retirement age (typically 67 for those born in later years), the benefit is reduced. Beneficiaries must decide whether the need for immediate income outweighs the long-term benefits of waiting.

- Retroactive Considerations: For survivors who depended on the government pension offset before these changes, the adjustments may be minor but still meaningful in the context of their overall financial planning.

This recalibration of spousal benefits is designed to reflect a more equitable approach. For many families, it eases the nerve-racking process of trying to patch together the full benefit from two different sources. Instead, they can now count on a more straightforward calculation that better aligns with their actual earnings and periods of service.

Strategic Decision-Making Amid the Policy Shift

For many affected beneficiaries, these changes have ushered in a period ripe for re-evaluating retirement planning strategies. The decision whether to pursue additional work, to claim spousal benefits, or manage yet undecided benefit filing options now comes with a balancing act that must account for switched-out pieces of the old system and the new relief provided by the Act.

Weighing the Options: A Step-by-Step Approach

When making decisions regarding how and when to claim benefits in a reformed framework, consider this simplified step-by-step approach:

- Assess Your Work History: Gather your quarterly credit records and evaluate how many credits you have accumulated compared to the 40 required to qualify for your own benefit.

- Analyze Benefit Projections: Request estimates from Social Security for both your own retirement benefit and any possible spousal or survivor benefits. Often, doing a side-by-side comparison can clear up many of the confusing bits.

- Plan the Timing: Decide when to claim your benefit—keeping in mind that claiming before the full retirement age reduces your benefit, while waiting beyond it does not necessarily increase your benefit if you are drawing spousal payouts.

- Consult a Professional: Given the various twists and turns in the regulations, it is advisable to work through the details with a financial planner or a trusted benefits advisor who can help you figure a path through these tangled decisions.

- Monitor Notifications: Stay alert to communications from Social Security regarding retroactive payments or adjustments to your benefits, ensuring that any discrepancies are resolved as soon as possible.

This methodical approach does not just help with making informed choices; it also reduces the overwhelming sense of uncertainty that can afflict many beneficiaries during times of policy transitions.

Impact on Specific Groups: Retired Educators, Public Servants, and Beyond

While the Social Security Fairness Act casts a wide net in terms of its beneficiaries, the implications for certain groups are especially noteworthy. Retired educators, public safety officers, and other public servants often find themselves at a distinct crossroads due to their unique work histories and pension arrangements.

Retired Educators and the New Regulations

Take, for instance, the case of a retired special education teacher who has already dedicated decades to a challenging profession. Many in this role have not only faced a lifetime of complex classroom challenges but have also had to account for benefit reductions when juggling their government pensions with potential Social Security income. With the Act removing the subtractive provisions, these educators enjoy a fairer calculation of benefits.

The following bullet list outlines some of the benefits for retired educators:

- Fairer Compensation: With the windfall elimination provision removed, retired educators are no longer penalized for having worked in roles that did not contribute fully to Social Security funds.

- Easier Comparison of Benefits: Educators can now more easily compare which benefit option—earning additional credits for a personal benefit or opting for spousal benefits—is more lucrative.

- Enhanced Financial Planning: The newfound simplicity allows educators to plan their retirements with greater confidence, reducing the nerve-racking complexity of prior benefit calculations.

- Retroactive Adjustments: Educators who were previously disadvantaged by the old rules can expect retroactive payments reflecting the period since the provisions were halted.

These changes are not only a welcome relief but also play a critical role in ensuring that those who have long served the public enjoy the retirement lifestyle they deserve. The elimination of these tricky bits of outdated policy is a step toward a more equitable social safety net.

The Broader Social and Economic Implications

Beyond the immediate relief for individual beneficiaries, the Social Security Fairness Act has wide-ranging implications for the broader social welfare system and political landscape. By addressing long-standing issues with benefit calculations, the Act reflects an evolution in the understanding of fairness in public policy.

Rebalancing Social Equity in Retirement Benefits

Historically, one of the major criticisms of the old system was its inherent inequity—benefits were reduced for a significant segment of the workforce based solely on the nature of their employment rather than their lifetime contributions. The changes are aimed at leveling the playing field:

- Equality of Treatment: The elimination of these provisions protects individuals from having their contributions undervalued simply due to the type of employment they chose.

- Boosting Consumer Confidence: As beneficiaries learn about the new, fairer benefit calculations, there is potential for increased public trust in the Social Security system, which many consider a critical pillar of retirement security.

- Policy Precedent: The Act sets an example of how aging policies can be reformed to meet modern standards of fairness and equity in a system that affects millions.

These broader goals are super important in understanding how incremental changes in policy can lead to an overall more balanced and trustworthy social framework. In effect, the Act sends a message that government programs must evolve with the times, ensuring that every segment of the workforce is treated with the respect and fairness they deserve.

Overcoming the Overwhelming Aspects of a Policy Transition

Despite the promising outlook, the transition period does come with its share of challenges. Many beneficiaries are understandably apprehensive when faced with such a significant policy shift, which can feel loaded with problems and overwhelming uncertainties.

Practical Steps for Managing the Change

For those feeling off-put by the sudden shift in regulations, here are some practical tips to help manage the change:

- Stay Educated: Take the time to dig into the details of the Social Security Fairness Act. Reliable sources such as official Social Security statements, trusted financial planning websites, and consultations with experts can provide clarity on even the most confusing bits.

- Review Your Records: Compare your work history with current Social Security statements to determine where you stand with respect to the 40-credit requirement. Keeping accurate records is essential in identifying any discrepancies early on.

- Consult Trusted Experts: Whether it’s a financial planner, a benefits counselor, or a legal advisor specializing in Social Security, getting professional guidance can help untangle many of the complicated pieces of your retirement plan.

- Plan for Flexibility: Given the possibility of retroactive adjustments, be prepared for your monthly benefit statements to change. A flexible financial plan that accounts for these potential adjustments can ease the transition.

While the future may seem nerve-racking in the immediate term, taking methodical, well-informed steps can help relieve the tension and allow beneficiaries to steer through the transition with confidence.

Personal Stories and Broader Reflections

The implications of the Social Security Fairness Act are best understood through personal narratives and real-world examples. Beyond numbers and policy changes, the Act affects lives, impacting the decisions of families, retirees, and future beneficiaries alike.

Reflections from a Life of Service

Imagine a retired public servant—a teacher, a firefighter, or a police officer—who has dedicated years of service to a community. Often, these individuals have come to expect that their hard work will translate into a secure retirement, only to find that outdated policies have undermined their benefits. With the Act’s new provisions, there is a renewed sense of justice and fairness.

Many beneficiaries are now sharing their stories of how the revised benefits will help them fund essential needs such as healthcare, housing, and everyday expenses in retirement. This change is not just a technical update; it is a promise of respect for years of untiring service. The removal of tangled issues that previously reduced their Social Security payouts restores a level of dignity and recognition long overdue.

The Ripple Effects on Families and Future Retirees

It is also important to consider the broader family implications. When a pension offset or windfall elimination once reduced a spousal benefit, it often placed additional financial strain on households. Now, with spousal benefits being calculated without the complications of the old rules, families can look forward to improved financial security.

Some of the benefits that ripple outward include:

- Improved Household Budgets: Couples who once faced reduced spousal benefits now have a more reliable financial foundation in retirement.

- Better Long-Term Planning: With a clearer picture of the benefits to come, households can design their long-term budgets more accurately and reduce the nerve-racking uncertainty of planning for the future.

- Mental and Emotional Relief: Removing one more stressful element from retirement planning is a welcome relief for many, alleviating the constant tension that comes with financial insecurity.

The implications extend even beyond those currently nearing retirement age. Future retirees who will benefit from these changes can now plan with the assurance that, if they work in non-covered jobs, they will receive a fair calculation of benefits when the time comes.

Looking Forward: The Future of Social Security Benefit Reform

While the Social Security Fairness Act represents a major milestone, it is also part of a broader discussion about the future of retirement security in America. As our society continues to evolve, so too must the programs designed to serve its citizens, especially in the realm of Social Security.

Potential Future Reforms and Improvements

Although the current Act addresses many of the immediate issues, it also raises questions about what else might be improved further down the line. Here are some areas garnering attention from policymakers and experts:

- Further Simplification: Future efforts may focus on making the Social Security system easier to understand and manage. This involves streamlining benefit calculations and reducing the number of confusing bits that complicate the decision-making process for future beneficiaries.

- Enhanced Communication: Improving how changes are communicated to the public could further alleviate some of the nerve-racking uncertainties. Clear, accessible notifications and educational resources would help millions know exactly what to expect.

- Additional Adjustments: Although the current reforms include retroactive benefits, future adjustments may look into ways to optimize retirement payouts further, ensuring no one is left shortchanged by the system’s earlier limitations.

- Expanding Eligibility Options: As the workforce changes, additional research may lead to expansions or modifications of eligibility criteria to better serve diverse career paths, especially those in public service where non-covered pensions have historically presented challenges.

These ideas, while still in the discussion phase, point toward a future where Social Security continues to adapt, ensuring that fairness is maintained as demographic and economic landscapes shift. The goal is to build a benefits system that every American can count on with confidence and ease.

Conclusion: Embracing a More Equitable Retirement Future

The Social Security Fairness Act signifies a bold step towards recognizing and remedying past imbalances within the Social Security system. By removing the windfall elimination provision and the government pension offset, the new law offers a lifeline to countless retired educators, public servants, and countless others who have long been burdened with reduced benefits despite a lifetime of service.

This reform is a reminder that while policies can be complicated and filled with twists and turns, taking a closer look reveals opportunities for improvement. Beneficiaries now have a renewed chance to plan for retirement without the additional nerve-racking challenges once imposed by outdated regulations. The new framework promises not only direct financial benefits through retroactive adjustments but also a significant boost in public confidence that the system is being reformed for the better.

For those approaching retirement—or even those already in it—this moment offers a chance to re-assess, re-plan, and perhaps even reimagine what retirement security should look like. Whether you decide to pursue your own benefit through additional work, rely on a spousal benefit, or simply wait for retroactive payments to adjust the financial scales, the key is to stay informed and seek guidance as needed.

The path forward, though still dotted with its own set of tricky parts and tangled issues, is now clearer than ever. Beneficiaries have more autonomy and fairness to rely upon, which ultimately enriches not just individual lives but the collective sense of equity in our social safety net. As the new law unfolds its full impact in the coming months and years, both individuals and families will be better positioned to face the future with optimism and a strong financial foundation.

In these times of significant change, embracing a proactive approach—staying educated, consulting with professionals, and carefully planning each step—can transform what might have been an overwhelming challenge into a manageable, even empowering, process. The changes wrought by the Social Security Fairness Act are not merely technical adjustments; they represent a broader commitment to fairness and respect for decades of public service. Let this be a time of reflection and renewed hope for a more equitable retirement future, where every work of service is rewarded in the fullest sense.

Ultimately, the act signals that our society values the contributions of its public servants and is determined to ensure that their retirement years are met with fair treatment, robust support, and the financial dignity they rightfully deserve. As we witness these legislative changes take shape, beneficiaries and policymakers alike find themselves engaged in sorting out the best ways to secure a stable and just future for all.

Key Takeaways: A Summary of the New Social Security Landscape

To wrap up this discussion, here’s a concise summary of the main points discussed in this editorial:

- Elimination of Reduction Provisions: The windfall elimination provision and government pension offset have been removed, leading to higher and fairer benefits for government pension recipients.

- Spousal Benefit Clarity: Beneficiaries now have a clearer choice between claiming their own benefit or a spousal benefit, with those choices being calculated more transparently.

- Retroactive Payments: Many affected individuals can expect retroactive adjustments to their benefits, beginning from when the law came into effect.

- Planning and Assistance: The new system encourages individuals to re-assess their retirement planning strategies and, if necessary, seek advice from financial experts to figure a path through the changed landscape.

- Future Implications: The Social Security Fairness Act is a foundational change that sets the stage for further improvements and a more equitable benefits system in the future.

This summary should act as a quick reference guide for anyone looking to understand the essence of the reforms and their implications for personal retirement planning. With careful navigation of these changes, the uncertainties of the past give way to an era where equitable treatment is at the forefront of retirement security.

As we continue to monitor the rollout of these changes, it remains essential for every affected individual to keep abreast of the latest updates, regularly review their Social Security statements, and be proactive in their retirement planning journey. In doing so, the challenges of today can be transformed into opportunities for a brighter, more secure tomorrow.

Originally Post From https://www.oregonlive.com/business/2025/04/liz-weston-social-security-changes-prompt-questions-about-spousal-benefits.html

Read more about this topic at

Do You Qualify for Social Security Spouse's Benefits? | SSA

How Are Social Security Spousal Benefits Calculated?

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.